Tag: Accountants North West London

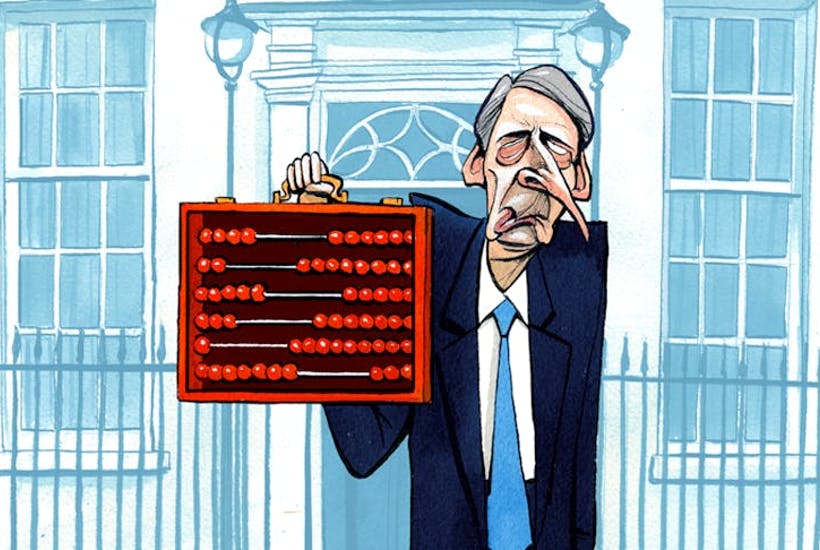

Autumn Budget 2017

Chancellor Philip Hammond presented the 2017 Autumn Budget against a backdrop of ongoing economic uncertainty. In no uncertain terms, this was a glum budget. The Office for Budget Responsibility revised down its outlook for productivity growth, business investment and GDP growth across the forecast period, though the chancellor challenged the nation to “prove them wrong”.

Off we go.

The Chancellor announced the immediate abolition of stamp duty land tax for first-time buyers on homes worth under £300,000, and a rise in the tax-free Personal Allowance to £11,850 from April 2018.

Also unveiled in the Autumn Budget was a change to business rates revaluations: these will now take place every three years, as opposed to every five years, beginning after the next revaluation, currently due in 2022. The Chancellor also addressed the issue of the so-called ‘staircase tax’.

Our Budget Report summarises the key announcements arising from the Chancellor’s speech. Additionally, throughout the Report you will find useful tips and ideas for tax and financial planning, as well as an informative 2018/19 Tax Calendar.

Don’t forget, we can help to ensure that your accounts are accurate and fully compliant, as well as suggest strategies to minimise your tax liability and maximise your profitability.

If you would like more detailed, one-to-one advice on any of the issues raised in the Chancellor’s Budget speech, including on the ensuing tax implications, please feel free to call on 020 8952 7717 to see how we can help.

What does the 2017 Spring Budget mean for you and your business?

Following the UK’s historic vote to leave the EU, and with Prime Minister Theresa May poised to trigger Article 50, Chancellor Philip Hammond presented the Spring Budget against a backdrop of economic uncertainty. Figures from the Office for Budget Responsibility revealed that UK economic growth is now expected to reach 2% this year, before falling to 1.6% in 2018.

The Chancellor announced a range of significant measures for businesses and individuals, including a support package for firms in England affected by the business rates revaluation and the announcement that unincorporated businesses and landlords with turnover below the VAT registration threshold will have until 2019 to prepare for quarterly reporting.

Also unveiled in the 2017 Spring Budget was a reduction in the tax-free dividend allowance, which will fall from £5,000 to £2,000 in April 2018.

Our Budget Report provides an overview of the key announcements arising from the Chancellor’s speech. However, it also looks beyond the more sensational measures and offers detail on the less-publicised changes that are most likely to have an impact upon your business and your personal finances.

Additionally, throughout the Report you will find handy tips and ideas for practical tax and financial planning, as well as an informative 2017/18 Tax Calendar.

Don’t forget, we can help to ensure that your accounts are accurate and fully compliant, as well as suggest strategies to minimise your tax liability and maximise your profitability.

If you would like more detailed, one-to-one advice on any of the issues raised in the Chancellor’s Budget speech, including on the ensuing tax implications, please feel free to call on 020 8952 7717 to see how we can help.

- ‹ Previous

- 1

- 2

- 3

- 4