News and Publications

Spring Budget 2024 – The leaked and leaky Budget

Spring Budget 2024

The Chancellor managed to find some optimism in the deteriorating economic forecasts, as most Chancellors, of whatever political hue, seem to do before an election. Mr Hunt announced a further 2% cut to national insurance, although it appears that the current budget deficit and the anticipated fall in inflation to 2% did not arrive in time to arm the Chancellor with the fireworks needed to queue an election. With this in mind, the Autumn Statement 2024 is now likely to be the “main event”, if we may, for the Conservatives to bring in a final raft of measures, including perhaps Mr Sunak’s long-forgotten “promise” to slash the basic rate of income tax from 20p to 19p by 2024.

Indeed the speech from Mr Hunt did not feel like a genuine election push; he rather serenaded the opposition and there was an absence of an impassioned pre-election tone. The Conservatives have accepted this election will go very late, or perhaps they have accepted that they will go down with dignity (and cheques that will bounce back).

Whereas in years gone by ministers responsible for leaks to the press resigned on the spot, party politicians have warmly embraced the new age of “populism” and the Budget was leaked, in drips and drabs over the course of the past few days, to various news organisations.

Headlines and commentary as follows…

Spring Budget 2024

Personal taxes

- Tax Rules for non-UK domiciled individuals – from 6 April 2025, the current remittance basis of taxation will be abolished for UK resident non-domiciled individuals. This will be replaced from 6 April 2025 with an elective 4-year foreign income and gains (FIG) regime for individuals who become a UK tax resident after a period of 10 years of non-UK tax residence. There will also be transitional provisions for non-doms currently paying tax on the remittance basis, including a 12% tax rate on foreign income arising before April 2025 but brought into the UK in the tax years 2025/26 or 2026/27. Do the Conservatives now feel that the abolition of these breaks will not result in a mass exodus? In practice, looking at the polls and the fairly imminent election, this particular measure won’t be in place before there is a change in government and any actual amendments to the regime are likely to be quite different.

- High Income Child Benefit Charge (HICBC) – the HICBC income threshold will be raised from £50,000 to £60,000 from 6 April 2024, and the taper will be extended up to £80,000. A migration to a system based on household rather than individual income is planned by April 2026.

- ISAs – introduction of a UK ISA with a new £5,000 allowance, in addition to the existing ISA allowance.

National Insurance contributions – whilst any “tax” cut is welcome, one must recall that the same percentage increase was levied by the same party in order to fund “social care”. Have then, the problems of social care been solved? Or do they no longer matter? The state of our public services will quite possibly be the biggest challenge of the next elected party.

- Class 1 – a cut to the main rate of Class 1 employee NICs from 10% to 8% from 6 April 2024.

- Class 2 & 4 NICs – a further cut of 2 pence to the main rate of Class 4 self-employed NICs from 6 April 2024, taking this to 6% of profits. The consultation to abolish Class 2 NICs to continue.

Property

- Capital Gains Tax (CGT) – a reduction to the higher CGT rate for residential property disposals from 28% to 24%. The change will take effect for disposals that take place on or after 6 April 2024. The lower rate of 18% will remain unchanged. For those with second homes, perhaps a “softener” to finance the VAT to be paid on school fees after the election?

- Furnished Holiday Lettings (FHL) – Were the tax breaks really responsible for exacerbating housing pressures of tourist areas to the detriment of local residents (many of whom also happen to be voters in marginal seats)? Draft legislation to be published in due course, but from April 2025, the generous tax advantages afforded to FHLs operating as either individuals or corporates will be abolished.

Excise and Duties

- VAT

- The VAT threshold will increase to £90,000 from 1 April 2024, and the level at which a business can apply for de-registration will increase from £83,000 up to £88,000. It is good to see the VAT threshold increasing, but we can’t help but ask Mr Hunt: why not go big and move the threshold to say £100,000? We feel that this would move the stifling cliff edge quite some distance for smaller traders; plus, a higher threshold could have taken out a large swath of businesses and reduced demand on HMRC, who are clearly struggling to perform.

- Also, the VAT implications for the private hire vehicle sector will be examined in April 2024, with potentially full expensing to give 100% corporation deductions for qualifying capital expenditure.

- Stamp Duty Land Tax (SDLT)

- First Time Buyers’ Relief will be extended to individuals who use nominee and bare trust arrangements when buying a new lease over a dwelling that they intend to use as their main or only residence.

- Abolition of Multiple Dwellings Relief, a bulk purchase relief within the SDLT rules available on the purchase of two or more dwellings.

- Vaping Duty – a new duty on vaping products will be introduced in October 2026, details on the design and implementation to be announced.

Business taxes

- Energy Profits Levy – the “temporary” tax on oil & gas profits introduced in 2022 has been extended to 1 March 2029. However, alongside this extension is a separate measure which will switch off this tax automatically if the average price for both oil & gas drops below certain thresholds.

- Creative Industries – New permanent rates of relief (40% and 45%) for theatre, orchestra and museums and galleries exhibition tax, and additional support for independent film through a new UK Independent Film Tax Credit at a rate of 53% for films with budgets under £15 million that meet the conditions of a new British Film Institute test. Plus, a 5% increase in tax relief for UK visual effects costs in film and high-end TV, under the Audio-Visual Expenditure Credit (AVEC).

- R&D – an expert advisory panel to support the administration of research and development (R&D) tax reliefs.

Tax administration

- Cryptoasset Reporting Framework (CARF) – the government has launched a consultation to seek views on how best to implement the Cryptoasset Reporting Framework and Amendments to the Common Reporting Standard.

Visit our Budget Highlights and tax data for a summary of the Spring Statement 2024.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Payrolling Benefits

What is a Benefit in Kind?

Benefits in kind (BIKs) are benefits that employees or directors receive from their employer which aren’t included in their salary or wages. BIKs are popular elements of many people’s salary packages and can be used by an employer to structure an effective and tax-efficient salary package.

Some BIKs aren’t taxed, but most are. As well as the impact on an employee’s personal tax, national insurance contributions are payable by companies, such that the tax treatment is broadly similar to that when paying a salary (although employer pension contributions are not due on BIKs).

What is Payrolling Benefits?

We are encouraging employers to take advantage of using payroll facilities for the purpose of reporting expenses and benefits. Rather than filing an annual P11D, an employer can report and deduct tax on the value of benefits provided to an employee each pay period though PAYE. This means doing away with the end of year P11D process, as taxes are submitted in real time.

HMRC will issue an employee with a new tax code to automatically account for the benefit provided and charge the correct amount of tax, in real time.

An employer will still need to complete and submit a P11D(b) form and pay Class 1A National Insurance on the value of the benefit provided to employees.

Employer Duties

Once an employer has registered to payroll benefits, they must give employees written notice explaining which benefits will be payrolled, the cash equivalent of the benefits, and details of benefits that will not be payrolled. Details on communicating with existing and new employees are set out on gov.uk.

Working out the taxable amount of a benefit in kind

The taxable amount of the benefit is the same as its cash value. This is then divided by the number of paydays the employee has in each pay period, so that tax is applied appropriately.

What if the value of the benefit changes?

It’s fairly common for benefits such as gym memberships and car costs to change during the year. If this happens, it’s simple to process the change. You must however ensure to keep us updated with changes when you communicate with us in the normal course of operating payroll. Examples of changes to the value of the benefit provided to the employee include:

- a change in price of the benefit, such as an increase in insurance premium

- a change in the number of days worked by the employee, including if an employee leaves

We recommend you discuss any benefit you plan to offer your company’s directors and employees with one of our expert accountants. As you can see, the rules around benefits in kind are complex and each example needs to be looked at based on its individual circumstances to see if any tax is payable by the employee and/or your company.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

ATED Valuation Update for 2023/24 return

ATED Update

Certain companies owning UK residential property need to submit an Annual Tax on Enveloped Dwellings (ATED) return every year. ATED is payable by companies that own properties valued at more than £500,000 if none of the various reliefs apply.

Valuation dates and the 2023-24 ATED return

Valuation dates are relevant for determining a company’s ATED position. It is the value of the property on the most recent of these valuation dates which is relevant for determining the annual chargeable amount due on the property. The previous “valuation date” was 1 April 2017, which applied for the 2018-19 ATED year and all ATED years up to and including this 2022-23 ATED year.

For the forthcoming ATED year 2023-24 and all ATED years up to and including the 2027-28 ATED year, ATED charges will be rebased to 1 April 2022 property values and so a revaluation of properties will be required as at 1 April 2022. ATED Returns are due within 30 days of the start of the relevant chargeable period i.e. by 30 April 2023 for the 2023/24 period.

Property Valuation

If a revaluation has not been carried out on properties, directors should consider doing so as a matter of urgency to ensure that future ATED liabilities are based on the correct valuation. This is especially important if the property is valued close to the ATED bands detailed below. Even if the company’s property is currently relieved from ATED, it would be prudent to have a 1 April 2022 valuation should circumstances change.

Property values were particularly volatile post-Brexit and there were instances where values actually fell when the April 2017 revaluation exercise was undertaken. Given the effects of the coronavirus pandemic on property values, similar considerations may apply when the 2022 valuation exercise is undertaken, although different considerations will apply to different regions and properties.

Directors can ascertain the property value or a professional valuer can be used. Valuations must be on an open-market willing buyer, willing seller basis and be a specific amount.

ATED Annual Chargeable Amounts

Annual chargeable amounts can be found on gov.uk.

Pre-return banding check

If your property falls within 10% of the above value bands and you can’t take advantage of a relief to reduce your ATED charge to nil, we can ask HMRC for a pre-return banding check (PRBC) in advance of submitting your return. If HMRC complete your PRBC after you’ve submitted your return and they don’t agree with your valuation, you’ll need to complete an amended return.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Spring Statement 2023

Back to the Future

Following the “Growth Plan” mini budget delivered by Kwasi Kwarteng on 23 September 2022, Jeremy Hunt took centre stage for the second time on 15 March 2023 to deliver a…”Budget for Growth”.

Fiscal policy can be assessed in three measures: efficiency, effectiveness and equity and whilst the announcements were fairly safe, a handful are poorly timed or likely to be ineffective:

- During an interview with BBC Radio 4 when defending the scrapping of the £1.073m tax-free cap on the lifetime pension allowance, Jeremy Hunt remarked that “we do know that we have a shortage of doctors and we know we have a very big backlog, and that is why we’ve decided this [scrapping of the lifetime pension allowance] is a very important measure to get the NHS working”. Said whilst junior doctors are on prolonged strike over pay and conditions; we suspect that Mr Hunt may have skipped his situational judgement module at Oxford!

- The Spring Budget is designed to “…break down barriers to work, unshackle business investment and tackle labour shortages head on”. Whilst the headline measure of 30 hours of weekly free childcare is a great and targeted initiative, Mr Hunt is making some parents wait up to 2 years and 5 months for the benefit.

As regards equity, the Budget is fairly safe and business-focused, but it does not appeal particularly to small and medium-sized enterprises (SMEs) who now face a rise in corporation tax and who are unlikely to benefit from the full expensing capital allowances policy. In addition the chancellor has failed to take any action to make it easier for small firms to recruit people locked out of the labour market.

In other news regarding:

- Childcare: Extension of 30 hours of weekly free childcare to cover nine-month to two-year-olds for working parents, to be fully phased in by September 2025.

- Taxes: Increase in corporation tax from 19% to 25%.

- Capital allowances: A “full expensing capital allowances policy” under which companies can write off qualifying expenditures against taxable profits.

- Research & Development: From 1 April 2023:

SMEs will received an increased rate of R&D relief from HMRC: £27 for every £100 of R&D investment if they spend 40% or more of their total expenditure on R&D.

the rate of the Research & Development Expenditure Credit (RDEC) is increased from 13% to 20%. - Energy: The government will keep the £2,500 annual cap on household energy bills in place for a further three months until June. Fuel duty has also been frozen for another year.

- Local growth: Tax incentives and other benefits for 12 investment zones across UK cities and towns worth £80m each over five years.

- Pensions:

- The annual tax-free pension allowance will be increased from £40,000 to £60,000.

- The Lifetime Allowance – previously set at £1.07m – will be abolished. The 25 per cent tax-free lump sump will though remain pegged to the current lifetime allowance, rather than 25 per cent of your whole pot.

- The money purchase annual allowance (MPAA) currently capped at £4,000 or £3,600 per tax year, has been increased to £10,000.

- Energy: Investment of £20bn over the next 20 years in carbon capture and storage projects.

- Pubs: A pint will become 11p cheaper but a glass of wine will cost 45p more from August.

Visit our Budget Highlights and tax data for a summary of the Spring Statement 2023.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Autumn Statement 2022

Taxing Times

In the latest decisive swoop of indecisiveness, Jeremy Hunt performed a 180 degree turn from the Mini Budget delivered less than two months ago by his predecessor. If the Mini Budget was dubbed “The Growth Plan”, can the Autumn Budget also be a plan for growth?

It was a step in the right direction: re-implementing fiscal discipline in an effort to re-galvanise trust in HM Treasury. Notwithstanding, it’s disappointing that fairer and more creative means of collecting taxes were not applied, rather than manipulating the tax bands in a move which fiscal-drags one and all. The 40% band no longer applies to the wealthiest. The capital gains tax rates on investment income are still only 50% of those paid on working income.

There were surely opportunities missed to rebalance the tax-system in a much-needed fairer way. Especially now in the face of a looming recession – or potentially depression, when the smallest tweaks in taxes and spending will have knock on effects on the amount of money that is spent on our high streets.

Taxes aside, there is risk of a continued disintegration of public services – this will come home to roost in two years if inflation continues its current trajectory amidst public spending cuts of £28bn.

Visit our Budget Highlights and tax data for a summary of the Autumn Statement 2022.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Earning over £100k: how to avoid the 60% Tax Trap

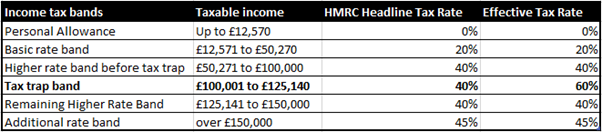

A pay rise or bonus that takes one’s annual income above £100,000 is cause for celebration. Tread though carefully these muddy waters, for additional income earnt up to £125,140 attracts the highest rate of marginal tax across all other taxpayers, including those richer than you. Read on for tax-saving tips on how to navigate the 60% Tax Trap…

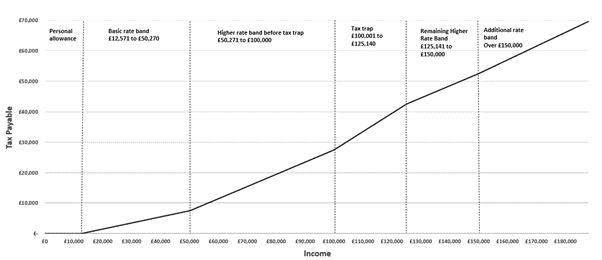

One’s Personal Allowance goes down by £1 for every £2 earnt over £100,000, increasing the amount of income that is taxed at the higher rate of 40%. One loses their Personal Allowance in full when their income reaches £125,140. The graph below illustrates how tax payable accelerates as income increases in the Tax Trap Band. Note the steepest gradient for income earnt in this range.

Avoiding the 60% Tax Trap

The incentive effect, or disincentive effect rather, of working to receive income in the Tax Trap Band, is punitive. For every £1 earnt, 60 pence are paid to the exchequer. Fortunately, there are several ways of avoiding or mitigating the 60% Tax Trap Band:

- Increase the amount paid into your pension

- You can receive tax relief on money saved into a private pension scheme, up to an annual allowance of £40,000. The allowance is reduced to a minimum of £4,000 if you earn high income or have flexibly accessed your pension.

- Ask for a non-cash bonus

- If you are not in need of liquidity immediately, then rather than receiving a cash bonus, you can ask for a non-cash bonus provided at low or no tax if received through a salary sacrifice scheme. Consider a company car with low emissions, childcare or private medical insurance.

- Invest in start-up investment schemes

- There are three start-up schemes you can invest in which give you a percentage of your investment back as tax relief: Seed Enterprise Investment Scheme (SEIS) – 50%, Venture Capital Trust (VCT) – 30% and Enterprise Investment Scheme – 30%. Speak to your adviser about building a portfolio which balances your appetite for risk and reward.

- Donate to charity and claim Gift Aid Tax Relief

If you anticipate that your income will exceed £100,000, talk to your employer about strategies to manage your tax position. As ever, Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

One Entertains: Tax Allowances for the Platinum Jubilee (and other Entertainment)

With the dust still settling on the Mall following a triumphant celebration of Her Majesty The Queen’s Platinum Jubilee, one may begin to consider the tax deductibility of hosting Diana Ross, Ed Sheeran and the like – a figure reported to be around £28m.

As a general rule for tax, expenditure on entertainment or gifts incurred in the course of a trade or business is not allowed as a deduction against profits, whether incurred directly or paid to a third party such as an events organiser. HMRC are not however completely devoid of holiday spirit and provided conditions are met, certain types of entertainment are allowable. Hurrah.

Promotional Events

Events which publicise a business’ products or services are not deemed to be entertaining expenditure and so direct costs are allowable for tax if they meet the “wholly and exclusively” test. The cost of related food, drink or other hospitality is however disallowed. For example if a car manufacturer organises a golf day at which test drives are available, only the direct costs of the test drives and of any publicity material provided are allowed, together with any immaterial costs such as teas and coffees.

Gifts

Costs are allowable where gifts incorporate a conspicuous advertisement, do not exceed £50 in value (for all gifts made to the same recipient in a year) and are not food, drink, tobacco or tokens or vouchers exchangeable for goods. This could be merchandise branded with the business logo.

Staff Entertainment

Entertaining staff is allowable provided that it is not merely incidental to customer entertaining. Regardless of any deduction allowed against the profits of the business, a tax charge may arise on the employee personally. Employers may need to report the event costs to HM Revenue & Customs (HMRC) on each employee’s form P11D and pay class 1A National Insurance. Generous employers can though opt to pay the Income Tax and National Insurance Contributions on behalf of employees by entering into a PAYE Settlement Agreement (PSA).

To avoid this complicated scenario and to ensure that staff entertainment is allowable, an event would need to meet the following conditions:

- Opening the party to all staff (not only to directors/management)

- Limiting the cost per staff member to £150 per head (inclusive of VAT) per year. In practice, this would mean limiting the cost per general attendee to £150 per head. One would also need to consider any future events in which the limit may be breached, for if the cost per head were to exceed £150, then no tax-deductible expense could be claimed, with a tax charge arising on employees.

To avoid a tax charge, the event would need to meet the additional condition of taking place annually! If an event were to include entertainment for staff as well as customers, the apportionment of expenditure on staff would be fully allowable, whilst the apportionment of expenditure on clients would generally be disallowable (with the exception of any gifts).

Recovering VAT on Entertainment

As a general rule, a business cannot recover input VAT related to client entertainment. VAT incurred on staff entertainment is however recoverable provided the following conditions are met:

1. Entertainment is not only provided for directors/partners

2. Costs incurred are not related to entertaining non-employees. For events which entertain both employees and non-employees, an apportionment of employee-related expenses and VAT would again be made.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Spring Budget 2022

A Targeted Budget

Amid soaring inflation of 6.2% and forecasts of the sharpest fall in living standards since records began (according to the UK’s fiscal watchdog), Rishi Sunak presented a Budget which he argued would support the UK economy, businesses and families in both the short and the medium term. In contrast to the profligate Budgets of very recent times, which were arguably necessary to address a pandemic that affected all areas of the economy from all angles, this was a targeted Budget with a laser beam pointed at the erosion of disposable incomes that is likely to pursue at least in the short term.

The key measures were as follows:

- regarding personal taxes, an increase to the threshold at which an individual will begin to pay NI from 6 July 2022, aligning it with the personal allowance which is set at £12,570 per annum

- regarding employment taxes, the Employment Allowance will be increased by £1,000 from 6 April 2022 to £5,000

- regarding duties, an immediate reduction in duty on diesel and petrol, by 5 pence per litre, for 12 months

- regarding VAT, a cut in the VAT levied on energy efficient upgrades, such as solar panels and energy efficient heating

Rishi Sunak saved the “crowd pleaser”, or “low-tax-Conservative-MPs-and-commentators pleaser” until the end – his virtual rabbit out of the hat, by promising to cut the basic rate of income tax to 19p in the pound in April 2024, conveniently a few weeks before many Tory MPs expect to face a general election. Rishi has kept what looks to be substantial powder for more election-fighting fireworks. Has he done enough for the poorest people in society? Having banked most of the fiscal good news he received – higher than expected growth and tax revenues this year – he could have gone further. He is building up a war chest for the autumn. Momentum politics.

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Construction Industry Scheme (CIS) and the Domestic Reverse Charge

Under the Construction Industry Scheme (CIS), a contractor deducts money due to a subcontractor and instead pays it to HM Revenue and Customs (HMRC). This deduction counts as an advance payment towards the subcontractor’s tax. The amount deducted is a percentage of the labour services provided. The Domestic VAT Reverse Charge is in addition to but separate from CIS tax.

VAT – Domestic Reverse Charge

To ensure VAT is reported correctly by businesses in the construction sector, the domestic reverse charge has been added to the existing CIS since 1 March 2021. Prior to 1 March 2021 the supplier (subcontractor) would charge VAT to the customer (contractor), collect it and pay it to HMRC. The contractor would reclaim the VAT amount paid in their VAT return. From 1 March 2021, the subcontractor must not charge VAT but instead specify that the reverse charge applies. The subcontractor then accounts for the contractor’s output tax and reclaims the exact same amount as input tax on the VAT return. The subcontractor effectively accounts for the VAT directly to HMRC, as opposed to paying it over to the contractor.

The reverse charge must be used for most supplies of building and construction services. Normally if any of the services in a supply are subject to the reverse charge, all other services supplied will also be subject to it. The charge applies to standard VAT services for businesses who are registered for VAT in the UK and in the kinds of construction work listed here. Even if a customer enters into 2 separate labour and materials contracts with the same supplier for works within the scope of CIS and the works are to be provided at the same time on the same site, the reverse charge will apply to both contracts (subject to the 5% disregard) as they comprise a single supply for VAT purposes.

If you supply building and construction services as a sub-contractor

You must use the reverse charge from 1 March 2021, if you’re VAT registered in the UK, supply building and construction industry services and:

- your customer is registered for VAT in the UK (check if your customer has a valid VAT number)

- payment for the supply is reported within the CIS (use the CIS online service to check your customer’s registration)

- the services you supply are standard or reduced rated

- your customer has not given written confirmation that they are an end user or intermediary supplier (an end user is someone who does not make onward supplies of the CIS services supplied to them)

If the above applies, you will not charge VAT to your customer, and they will account for the VAT themselves. You should not charge VAT on the invoice but specify that the reverse charge rule applies. Page 8 of this guidance shows an invoice template.

If you buy building and construction services as a contractor

You must use the reverse charge from 1 March 2021 if you’re VAT registered in the UK, buy building and construction industry services and:

- payment for the supply is reported within the CIS

- the supply is standard or reduced rated (check if your supplier has a valid VAT number)

- you’re not using the end user or intermediary exclusions

If the above applies, you must ensure that your supplier does not charge you VAT (and you do not pay VAT to your supplier), as you should instead account for VAT using the domestic reverse charge procedure.

Settling with HMRC

A contractor must register for the scheme. CIS deductions made will be added to PAYE liabilities.

A registered subcontractor will have 20% deducted from its payments, whereas an unregistered subcontractor will suffer a 30% deduction. A contractor and subcontractor must register as both. Each time tax is withheld from payment to a subcontractor, the subcontractor must be presented with a CIS Payment and Deduction Statement from the contractor. This is used to reclaim tax from HMRC.

A sole trader or partners subtract CIS deductions suffered against income tax and national insurance on the Self-Assessment Tax Return. A limited company subcontractor offsets CIS deductions suffered against PAYE payroll liability. Unrelieved CIS tax deductions at the end of the tax year can be refunded into a bank account or offset against other outstanding tax liabilities, in which case an online form needs to be submitted. A subcontractor who meets the revenue thresholds and has a record of timely tax payments can apply for gross payment status, meaning that they will be paid in full by contractors, without deductions.

Our tech-enabled CIS and payroll service will help:

- Advise on your optimal business structure

- Ensure that you remain compliant and avoid the many pitfalls

- Onboard you to a cloud invoicing facility, with customised invoice templates for each customer or supplier

- Email deduction statements directly to your subcontractors

- Pay your subcontractors directly using our highly secure cloud payroll + payment integration

Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Automate Salary Payments

You may be all-too-familiar with the process and time spent dealing with payroll and HR: emails, telephone calls, attachments, more emails to employees, setting up bank payments…the list goes on. Large businesses will have segregated duties, with an HR lead responsible for managing joiners and leavers and holiday requests, an Operations Manager for coordinating and communicating shifts, a Payroll Manager and a Financial Controller. For small-to-medium sized businesses, the responsibility often lies with the managing director. In this regard, there are some fantastic tools to make managing your team more pleasant and more efficient, including the new way to automate salary payments.

Paying salaries

The latest integration to the cloud payroll ecosystem automates the payment of staff salaries. Currently, we prepare a BACS payment file which many employers upload to their online banking facility for processing onwards payments. The latest payments platform goes a significant step further and allows us as your accountants to make payroll payments, linked to your payroll information, shortly after the payroll is approved, saving you precious time, removing manual processes, and eliminating costly errors. The seamless workflow is protected by two factor authentication and payments are processed through a highly secure and compliant network. This solution benefits all employers with a high headcount and who pay their staff via bank transfer.

Employer and Employee Portal

By integrating with our payroll software in the cloud, we can streamline the way you communicate payroll information to us, including hours worked, holiday days taken, bonuses or new starters. A browser- or app-based Employer Portal allows you to enter relevant information, store and organise documentation (including payroll reports which we prepare) and make final approvals. We can email your employees their payslips directly, or even grant them access to the Employee Portal, where they can retrieve payslips (including past payslips), submit holiday requests, enter starter data…etc. This functionality benefits businesses in all sectors, as it is centred around improving the information flow between the employer, the employees and the accountant.

Rota Management

If your business requires organising shift patterns for your staff, we can help you implement software which helps you schedule rotas, optimise wage spend, record attendance and approve timesheets for payroll. Your employees would receive pop-up notifications and would log their check-in and check-out times in the app. The app can then produce weekly reports showing hours worked and wages due. There are also built in features such as overtime pay and GPS, which would ensure that employees can only log in when actually present. We have found this software to be particularly helpfuly for hospitality businesses and beauty salons.

How much does it all cost?

The payment integration and cloud hosting is priced based on the number of active employees, and the efficiency saving will tend to outweigh the fee for a payroll with at least 4 employees.

Our Information Sheet sets out a full list of our integrated Payroll and Pensions services.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.