Category: Business Planning, Performance and Growth

Hair Salon Business Model: which style suits you?

As a hair salon or barber shop owner, you aim to run your business in a way that maximises revenue, reduces costs, and ensures a good working relationship with your staff and customers. It is important to choose the right model that suits your business needs from the outset. We discuss below three different models of business:

- Full operation, whilst operating:

- a PAYE scheme

- a self-employed model for hairdressers

- Chair rental

- charging a fixed weekly rent to barbers

- charging a percentage of the chair’s takings

- a combination of a and b

- Shop rental

Full Operation

Full operation is the most involved and therefore carries the capacity for highest profits. This model also incurs the highest administrative costs, both in terms of money and time, including:

- Paying over 20% VAT on your sales if turnover exceeds £85,000

- Maintaining a payroll service to your staff

- Carrying out senior management responsibilities

Self-employed basis

As senior manager, you could continue operating the business, whilst moving some of your staff to a self-employed basis. The benefit of transitioning could save money in the following ways:

- No legal obligation to pay for sickness, maternity or holiday

- You avoid paying Employer’s national insurance

- There is no need to worry about auto enrolment pensions or make contributions

Should you pursue this model, it would be worthwhile implementing a service contract with the freelancers, to ensure that both parties’ expectations are understood. Of course, the risk of a barber turning up late, taking a day off or poaching clients for their own business remains. You should take on full advice, including with respect to legislation around self-employment.

Internal Controls

If you are not present at the salons throughout the day, it would be worthwhile implementing Internal Controls. These should be considered especially if you will continue to operate the salons, or even if you plan to sub-let at a variable rate dependent on performance. Internal Controls for cash sales and collections include:

- Reconciling till rolls to cash collections each day.

- Reconciling cash collections with banking and sales records each day.

- Restricting the receipt of cash and the recording of sales by making sure that only one person is in charge of the cash register.

Internal Controls to accurately track employee time should be considered if you are paying your staff per hour, either as employees or subcontractors. To help you accurately monitor and control employee timesheets, we have helped our clients implement an app-based time management software which you or your management could use to organise rotas.

Chair rental

There are three models to renting out chairs:

- Charging a fixed weekly rent to the freelancer

- Charging a percentage of the chair’s takings

- A combination of a and b

With option 1, if there is a high volume of customers for a particular chair you will lose out on sales as the freelancer will take all of the earnings. Option 2 avoids this problem, however if the freelancer doesn’t turn up for work then you lose out on rental income compared to the first model. A combination of the two methods is arguably the best way forward, however it would require monitoring of sales figures. The incentive agreement should be set at a level where the freelancers have the potential to make more money than they currently do.

You would need to charge VAT on rental income should your turnover exceed £85,000. A non-VAT registered freelancer would then suffer the VAT. Of course, the barber may also seek VAT registration, depending on his or her particular circumstances.

Compared to the full operation model with staff there will be no wages, national insurance and pensions costs however sales will be limited as per your agreement with the freelancers. Should you pursue this model, it would be worthwhile:

- implementing a service contract with the freelancer. It would be important to draft strong payment terms to avoid the risk of arrears.

- implementing an EPOS till system to give you full visibility of sales (important with incentive agreements).

- considering whether you would allow freelancers to sell their own products, or take a commission from your sales.

An additional risk compared to an employee-based model is that freelance workers may come and go, thereby requiring more management time to maintain occupancy.

Shop rental

This option is the least involved. If you do not foresee a pick-up in footfall in your salon, you may consider subletting your salon and collecting the passive income. You should bear the following points in mind:

- First check whether your lease allows you to effectively sub-let the premises.

- Should turnover increase more than you anticipate, you will not be sharing in the upside.

- Should you eventually sell the business, your eligibility to pay the Entrepreneurs’ Relief rate of CGT of 10% will be in jeopardy.

Summary

- The full operation model has the greatest potential for maximising profitability but carries the highest level of administrative costs.

- Internal controls regarding hours worked and wages paid are paramount, especially if you will continue to be directly involved in the full operation of the business.

- If you decide to base your business model around working with freelancers, it is important that both parties’ duties are understood (owner and freelancers). A service contract between parties is key.

- If the chair rental model is pursued you will need to charge VAT if rental income exceeded £85,000, which a freelancer could then suffer.

- The chair rental model is the most cost-effective option, but you risk losing out on revenue if there is a high level of footfall.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Technology and Professional Services Grant for SMEs

The government has announced details of new funding, designed to help small and medium sized businesses (SMEs) access technology and advice. SMEs will have access to grants of between £1,000 – £5,000 to help them access new technology and other equipment as well as professional, legal, financial or other advice to help them get back on track. The programme is due to launch in September.

Funds could be deployed to help businesses in the following ways:

- Advice on implementing technologies to streamline operations, for example apps to organise rotas and reporting for staff

- Equipment to facilitate efficiencies, including with respect to financial reporting or continuing to deliver business activity in response to COVID-19

- Legal advice regarding getting back on track and managing stakeholders, including HR

- Professional advice to review business strategy or business models

- Coaching and mentoring in leadership and management development

- Innovation strategy to adapt and diversify products or services

- Developing or revising marketing or digital strategies to reach new markets

- Mitigating the impact of social distancing measures

- Legal and environmental health compliance

- Skills analysis and development plans

- Employee engagement, welfare and wellbeing

Mouktaris & Co provide many of the services which will be eligible for this support, including accountancy services, business advice, legal services and HR support. If you have considered a project or initiative to develop your business, the grant program may be suitable for you. You can access the funding – provided by the England European Regional Development Fund – as part of the European Structural and Investment Funds Growth Programme 2014-2020, through 38 growth hubs within a Local Enterprise Partnership (LEP) area. If you are interested in support, advice or funding associated with your business venture, please contact your nearest LEP growth hub.

Further information

- The support will be fully funded by the Government with no obligation for businesses to contribute financially.

- Amongst other eligibility criteria, a business must have been trading on or before 1st March 2019 and should still be trading.

- The grant must cover 100% of the service a business is procuring (up to a maximum total project value of £5,000). The grant cannot be used to part-fund expenditure.

- Grants must be claimed within one month of receiving confirmation that the application has been accepted and upon production of an invoice for the claimed service or goods.

- Growth Hubs work across the country with local and national, public and private sector partners – such as Chambers of Commerce, FSB, universities, Enterprise Zones and banks, coordinating local business support and connecting businesses to the right help for their needs. They are locally driven, locally owned and at the heart of the government’s plan to ensure business support is simpler, more joined up and easier to access. A Growth Hub will therefore encourage you to utilise specialist advice from a local supplier.

- The funding being provided to businesses is supported by the England European Regional Development Fund as part of the European Structural and Investment Funds Growth Programme 2014-2020. The funding has been allocated to Growth Hubs within each LEP area in line with the current ERDF Programme.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice, including ideas on deploying funds to help your businesses grow.

Professional Services Firm: LLP or LTD

We are often asked to advise our Professional Services clients, lawyers and accountants, on the optimal business structure: LLP or limited company (LTD).

Whilst the statutory and accounting filing requirements are similar across both structures, the LLP was introduced to offer flexibility in management and pay: both important in human-capital-intensive Professional Services Firms. An LLP is controlled by its Members and governed by the Members Agreement, whilst a company is controlled by its shareholders under the articles of association and shareholders’ agreement.

Soon after their introduction, LLPs became the go-to model for Professional Services Firms because of the ability to:

- split partnership profits between Individual Members, taxed at income tax rates, to reflect profit or performance targets;

- appoint a Corporate Member to absorb “excess partnership profits” in a given financial year, taxed at a lower (corporation) rate of tax and available for reinvestment in the business;

- appoint and remove partners without the complex process and costs of them conferring or relinquishing shareholdings, and without the tax costs were any shares obtained at undervalue.

Tax

We know that LLPs are tax transparent and that Individual Members are usually treated as self-employed and taxed at income tax rates, subject to HMRC tests. On the contrary, a company pays corporation tax on profits: a company’s directors receive salaries subjected to PAYE whilst its shareholders pay income tax on dividends voted by the directors.

Some of the benefits of an LLP therefore centre around the following:

- An Individual Member of a trading LLP is taxed as if they are carrying on a trade directly for income tax purposes. This treatment carries certain tax advantages compared to the treatment of employees:

- Expenses are generally deductible for tax purposes if they are wholly and exclusively incurred for the purposes of the trade. This is in comparison to wholly, exclusively and necessarily incurred for employees.

- Pay as you earn (PAYE) does not apply and tax is generally only payable twice yearly rather than monthly as the individual members are not employees.

- Employer national insurance contributions (NICs) (currently 13.8%) are not payable in respect of the amounts payable to the individual members of the LLP as they are not employees.

- Members can flexibly adjust how the LLP is governed as Members arrive and leave and how Members are remunerated.

Pre-2014: LLP the way to be

Previously and in accordance with a Profit Sharing Agreement (part of the Members Agreement), LLPs enjoyed the ability to apportion taxable profits between Individual Members and Corporate Members, who pay contrasting rates of tax (sometimes 45% vs 19%). LLPs proved to be an effective structure for the governance of a Professional Services Firm, whilst also offering a “hybrid model” of taxation, whereby Individual Members were taxed at income tax rates on income drawn and presumably spent, whilst Corporate Members were taxed at a lower corporation tax rate on excess profits retained for capital expansion of the business.

Post-2014: LLP attack

The mixed membership partnerships anti-avoidance legislation of Finance Bill 2014 brought about a significant change in partnership taxation. Leading up to the change in law, it had become relatively common to see partnerships (including LLPs) with mixed Individual and Corporate Members. In short, the legislation provided for profits allocated to a non-individual partner (B) in a mixed member partnership to be reallocated to an individual partner (A), such that they are taxed at the individual partner’s rate of tax, if either:

- Condition X: it is reasonable to suppose that:

- B’s profit share includes an amount representing A’s deferred profit; and

- A’s profit share and the total amount of tax for which A and B are liable (relevant tax amount) are lower than they would have been absent the deferred profit arrangements.

- Condition Y: B’s profit share exceeds the appropriate notional profit, A has the power to enjoy B’s profit share and it is reasonable to suppose that:

- B’s profit share (or part of it) is attributable to A’s power to enjoy; and

- A’s profit share and the relevant tax amount are lower than they would have been absent A’s power to enjoy in B’s profit share.

Almost overnight, the mixed membership partnership rules led to a decrease in the popularity in the use of LLPs with Corporate Member structures amongst the SME business community and in some cases the unwinding of existing LLP structures.

Action

For mixed partnerships, the following steps could be considered:

- Outright incorporation. This clearly removes the issue of reallocation and provides a deferral of higher tax rates while the company retains the profits.

- Eliminate the corporate members and accept the income tax result. This in effect concedes the full impact of the new rules, so could be combined with exploring other approaches.

- Establish a company owned by the partnership to operate the business with or without the capital assets, ie the corporate is a subsidiary, not a partner. This may provide a possible solution in allowing ownership to change in a partnership rather than a share capital company, but with suitable profit retention for working capital by the operating company.

- Retain the existing structure with corporate members’ shares in amounts that can be justified by the new rules for services or the provision of capital.

- Consider the use of alternative business structures which should not result in reallocations between partners. These require specialist consideration by reference to the case and a range of other relevant legislation.

Clearly the tax effects of making a change will need full review, such as the availability of incorporation relief from capital gains tax, stamp duty land tax, and the impact of entrepreneurs’ relief. You can rely on our expertise surrounding companies, partnerships and tax for the delivery of the sound ideas needed to put plans into action:

- We help businesses manage all aspects of structure from set-up and management to dispute resolution and exit strategies

- We look at tax structures

- We understand the differences in structure between a partnership and a company;

- We advise on adapting a structure that is no longer fit for purpose.

Contact Mouktaris & Co Chartered Accountants for help planning your Professional Services Firm expansion.

The Coronavirus Local Authority Discretionary Grants Fund

The Chancellor announced further government support to small businesses with fixed property costs, that are not eligible for the Small Business Grant Fund or the Retail, Hospitality and Leisure Grant Fund.

The grant is designed to allow businesses to continue meeting their property-related overheads, so that in turn less strain is placed on landlords, who of course have their own commitments and obligations.

These businesses may now be eligible for a grant of £25,000, £10,000 or any amount under £10,000. Critically, grants will be awarded to eligible businesses on a first-come, first served basis until all the fund has been allocated. We encourage our clients who believe that they may be eligible to visit their local council’s website to find out how to apply. The local council will run an application process and decide whether to offer the grant.

ELIGIBILITY

You may be eligible if your business:

- is based in England

- has relatively high ongoing fixed property-related costs

- occupies property (or part of a property) with a rateable value or annual mortgage/rent payments below £51,000

- was trading on 11 March 2020

- did not claim under another government grant scheme, such as the Small Business Grant Fund or the Retail, Hospitality and Leisure Grant

Local councils have been asked to prioritise businesses such as:

- small businesses in shared offices or other flexible workspaces, such as units in industrial parks or incubators

- regular market traders

- bed and breakfasts paying council tax instead of business rates

- charity properties getting charitable business rates relief, which are not eligible for small business rates relief or rural rate relief

You will need to show that your business has suffered a significant fall in income due to coronavirus and you should contact our office if you require assistance putting together a claim.

We are doing everything we can to help our business community. If you would like to discuss how the changes or the coronavirus pandemic may affect you or your business, please do not hesitate to contact us on 020 8952 7717 or use our online enquiry form.

Coronavirus Bounce Back Loan Scheme

Among the range of UK Government measures to help protect businesses and individuals from the economic impact of coronavirus, the latest to be announced is the Bounce Back Loan Scheme (BBLS). Launched on Monday 4 May 2020, smaller businesses impacted by coronavirus are now able to apply for funding support of up to £50,000 via the BBLS if certain eligibility criteria are met.

HOW CAN I GET HOLD OF THE MONEY?

The BBLS provides lenders with a government-backed guarantee of 100% to offer loans of up to £50,000 to businesses across the UK that are losing revenue as a result of the COVID-19 outbreak.

BBLS is administered by the British Business Bank and made available to businesses via accredited lenders. It is currently open until 4 November 2020.

KEY FEATURES OF THE SCHEME

- Facilities to £50,000 or 25% of turnover, whichever lower, for eligible businesses.

- Repayment terms: six years, with no penalty for early repayment.

- Interest rate: 2.5% per annum. Interest is payable by the government for the first 12 months.

- Personal guarantees: No personal guarantees. No recovery action can be taken over the borrower’s main home or primary personal vehicle but, for sole traders or partnerships, other personal assets may be at risk of recovery action.

- 100% guarantee: The scheme provides the lender with a government-backed guarantee (100%) against the outstanding facility balance (principal and interest).

- The borrower always remains 100% liable for repayment of the debt.

- The borrower must self-declare they meet the eligibility criteria and make certain confirmations of solvency.

TO BE ELIGIBLE FOR THE BBLS

A business must confirm:

- It is a UK limited company or partnership, or tax resident in the UK, that was carrying on business on 1 March 2020.

- More than 50% of its income is derived from its trading activity.

- The loan will not be used for personal purposes but as an economic benefit for the business.

- Whether or not on 31 December 2019 it was a ‘business in difficulty’ (see definition in FAQs for Small Businesses: Bounce Back Loan Scheme) and does not breach state aid restrictions. If it was a ‘business in difficulty’ then, in addition, the facility will not be used for export-related activities.

- It is not in bankruptcy, debt restructuring proceedings or liquidation.

- Its understanding of losses that may be incurred, impact on credit rating, reduced consumer protection and that the lender will not assess affordability.

A business will be subject to standard checks such as customer fraud, Anti-Money Laundering (AML) and Know Your Customer (KYC) checks.

Ineligible businesses and sectors: banks, building societies, insurance companies; the public sector including state-funded primary and secondary schools; or an individual other than a sole trader or partner acting on behalf of a partnership.

Businesses that have utilised the Coronavirus Business Interruption Loan Scheme (CBILS), the Coronavirus Large Business Interruption Loan Scheme (CLBILS) or the Bank of England’s Coronavirus Corporate Financing Facility (CCFF) cannot also use the BBLS unless that loan will be refinanced in full by the BBLS.

We are doing everything we can to help our business community. If you would like to discuss how the changes or the coronavirus pandemic may affect you or your business, please do not hesitate to contact us on 020 8952 7717 or use our online enquiry form.

How to Invest Business Profits

With many entrepreneurs accumulating cash in business accounts, the question of “how to invest business profits?” is a favored topic when planning.

Entrepreneurs work hard for their businesses and this short article explores how business funds can work hard- or most effectively, for entrepreneurs.

Let’s take the following scenario: your business is profitable and has accumulated cash. During the years of trading, you have typically drawn an annual salary and dividends of £45,000, a point at which you are paying the basic rates of tax. Now with a stockpile of cash in the business, there are two options through which to invest. Should you personally draw additional funds from the company to invest, or alternatively should you invest from within the corporate structure?

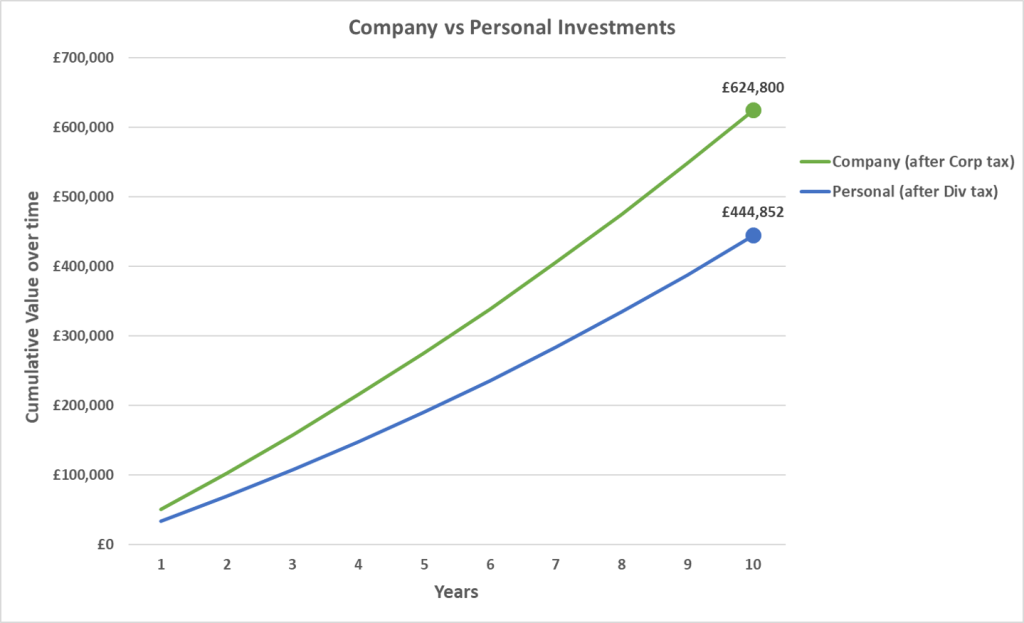

Assume in both cases there is a £50,000 cash surplus in the company. Assume also that this happens every year for the next 10 years.

Personal investment through your ISA

To take the money out of the company, you would pay dividend tax of 32.5% upfront. You (and perhaps your partner) could then invest your money tax-free, say in an ISA wrapper, in which your combined ISA allowances are currently £40,000.

Investment through your Company

Investing the money within the company would mean no upfront dividend tax of 32.5%. You would instead pay corporation tax on the investment income and gains annually, with the caveat that dividends received from stocks and shares are mostly exempt from corporation tax. This is a considerable advantage.

Let’s see how the two strategies fare:

As you can see, investing the money in a limited company yields approximately £180,000 more over a ten-year time horizon. The cost of paying the dividend tax upfront outweighs the benefit of tax-free personal investments. Why should you lose out?

Compounding evidence

You will notice immediately from the graph above that investing your company’s profits in the corporate vehicle, without paying dividend tax, allows the investment to accumulate, or compound, at a faster rate, even after paying corporation tax on investment income and gains.

Sure, if you do not draw the surplus funds from your company you may need to take a 32.5% dividend tax rate hit at a later date, but in the interim you will have generated greater income through compounding.

Caveats

Here we assume constant tax rates at the points of execution, income and realisation. It would be unwise to speculate on domestic policy, but current political trends and economic philosophy may see a conservative government try to enforce its stronghold on previously labour heartlands. Corporation and dividend tax rates could well rise before they fall.

You may find that transaction costs are slightly higher for corporate accounts, chipping away at annual returns. You will need to shop around harder for a broker. Equally personal brokerage accounts tend to be more insurable than corporate accounts.

Investing through a Limited Company

If the preference for investing through a Limited Company has been established, so should the mechanism through which to do so. Yes, you could simply open an investment account for the existing trading company, however there are several reasons why a designated investment company is superior:

- If the trading company runs into legal issues, the investment company will be protected.

- The trading company can be sold off as a standalone vehicle without the need for complex restructuring.

- An investment company will have minimal expenses and overheads, meaning it will be easier to administer for tax purposes (no VAT or payroll requirements).

- A trading company shouldn’t start investing in activities outside its core functions as it could end up becoming reclassified. This may carry tax implications, especially if Entrepreneurs’ Relief is sought.

Whilst the trading company is often the vehicle in which profits have been generated and accumulated, there are tax neutral ways of shifting funds to an investment company, such as lending the cash surplus. There is no obligation to pay back the loan and one can be the sole director of both companies.

A Holding Company

A holding company structure that owns operating companies and receives dividends is favourable. The holding company can own shares in the subsidiary trading companies and can provide centralised corporate control. Additionally, no taxes would be incurred when the trading company is sold.

Special Purpose Vehicle (SPV) for Property

If you want to invest in property it may be a better idea to set up an SPV. This is often a requirement from buy-to-let lenders. If you are looking to acquire a primary residential residence however, personal ownership is often the best way to go.

Don’t let the tax tail wag the investment dog

Your investment goals will seek a level of risk and return that you are comfortable with, regardless of the structure through which you pursue them. The tax wrapper is the “cherry on the top”, though worth a certain percentage of your annual returns. Contact Mouktaris & Co Chartered Accountants for an accountant who understands your investment strategy and can help you plan accordingly.