Category: Taxation

EIS Tax Relief for Joint Investment

The following scenario often arises with our client Mr Investor, who is considering investing in an early-stage business. Wonderful Ltd is an established FinTech company which has developed a track record of an established user base, consistent revenue figures and other key performance indicators. Wonderful Ltd is now seeking to raise Series A funding of £1.5 million in order to further optimize its user base and product offerings. Mr Investor has received an Investment Memorandum for the funding round and is considering allocating a small proportion of his investment portfolio. Mr Investor has asked his accountant to run through the Investment Memorandum with him and has identified five reasons why he wishes to invest. Being an early-stage business, Mr Investor acknowledges that the investment is inherently high-risk, but he really believes in the founder Mrs Wonderful, who attended the same university. The generous Enterprise Investment Scheme (EIS) tax breaks “cushion” the risk element of the investment (see below) but nonetheless, the minimum investment of £75,000 is punchy for Mr Investor.

Mr Investor has an idea. Can he pool together capital from two other friends in order to meet the £75,000 minimum investment? Will each investor still be eligible for the EIS tax relief for joint investment?

Joint Investment – A Problem Shared is a Problem Halved

In short, there is a way to pool funds in order to meet one investment clip of £75k. EIS relief is available for an individual who makes the subscription on his or her own behalf, with two notable exceptions:

- Individuals who use another person as a nominee to subscribe for the shares, or be registered as the holder of them, on their behalf, are treated as themselves being the subscriber.

- Individuals who invest jointly with others, with the result that the subscribers are in law acting as bare trustees (whether for themselves or for others), are themselves as individual beneficiaries treated as being the subscribers.

Mr Investor can therefore form a bare trust with his friends (as in point 2) in order to make a direct investment jointly. Where shares are issued to a bare trust on behalf of a number of beneficiaries, each beneficiary is treated as having subscribed, as an individual, for the total number of shares issued to the bare trustees divided by the number of beneficiaries. This creates an important limitation in that each of the three friends should invest an equal percentage in Wonderful Ltd.

Paperwork

Wonderful Ltd should provide each subscriber form EIS3 showing the total number of shares subscribed for on Page 1 of the form. Form EIS3 Page 3 should show the amount on which each owner is entitled to claim the tax relief for the shares, that is the fractional amount of the total subscribed.

Tax Relief?

Whilst joint investment does not preclude EIS tax relief, Mr Investor and his associates must of course check that all the other EIS eligibility criteria are met for EIS tax relief to apply. Mouktaris & Co can provide a checklist of questions to ask in order to determine whether tax relief under EIS is available to an investor in shares. The target company may produce an Advance Assurance document to potential investors demonstrating that HMRC accepts the investment under the scheme, however Advance Assurance will not tell you if an investor would meet the conditions of the scheme.

EIS Investment Funds

A different route (via point 1 above) would be for Mr Investor to invest via an EIS investment fund, which is structured as a nominee vehicle which invests funds in EIS-qualifying companies on behalf of investors. This vehicle would provide Mr Investor with a more diversified risk exposure to early-stage businesses, as his £25,000 investment would be spread across a number of target companies identified by the fund manager. Wonderful Ltd may seek to market its strengths to the EIS investment fund manager so as to be included in the fund’s equity holdings. So in fact Mr Investor could in the future invest in Wonderful Ltd through an EIS investment fund without necessarily being reliant on his friends’ capital.

EIS for Investors: Advantages

- As a reminder, EIS investors receive the following benefits as a result of participating in the scheme:

- A 30% income tax break against the amount invested

- No capital gains tax (CGT) to be paid on any profit arising from the sale of the shares, as long as they are held for at least 3 years

- Payment of CGT can be “rolled over” if the money gained is invested through EIS. The investment must be made 1 year before or 3 years after the gain occurred

- No inheritance tax is payable provided shares are held for at least 2 years

- If the shares are sold at a loss, the loss can be offset against any income tax in that year or the previous year

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Wealth Tax?

Calls for a wealth tax have so far been made with little impact, amid fears that a levy on assets would not go down well with conservative – or even not-so-conservative voters, and could hurt people with valuable homes but little cash. However, the Wealth Tax Commission said the timing was ripe for radical change due to the devastating impact of Covid on the public finances and on inequality in Britain.

The Wealth Tax Commission was established in Spring 2020 to ‘provide in-depth analysis of proposals for a UK wealth tax’. It’s not a government body, but a ‘think-tank’ funded by the London School of Economics, Warwick University and the Economic and Research Council (itself a public body). The Commissioners comprise a senior academic from the LSE and Warwick university and a very well-known tax barrister.

Whilst conclusions published last week may therefore not directly reflect government policy, they do propose an academic and practical solution to shore up public finances in these times of crisis – and should be afforded some serious attention. Readers may consult the full 126-page report here. For those with less time, the key points are below.

The report does not argue for the idea of an annual wealth tax. However, it’s strongly in favour of the levying of a wealth tax on a one-off basis to deal with an exceptional need – being that of repairing the alarming hole in public finances caused by coronavirus. The basic premise is therefore based not on redistribution but pragmatism – and the best place to get the money is from people who have it.

Interestingly, that pragmatism contrasts with the reasons that people who support the idea of wealth tax give for doing so: ‘filling a hole in public finances’ comes in only at fourth place, after ‘the gap between rich and poor is too large’; ‘the rich have got richer in recent years’; and ‘better to tax wealth rather than income from work’.

The report leans on a simplified design and implementation to maximise the efficacy of the tax – with the scope to avoid the net limited to such matters as redistribution, relocation or releveraging – all within a potentially short period of time.

How do the Commissioners propose a Wealth Tax should work?

- It should be levied at the same rate on all assets including the family home, businesses and pension funds. Special reliefs or exemptions would reduce the efficacy of the program by decreasing the yield, complicating the administration and affording opportunities for avoidance.

- It should be levied by reference to wealth as at a single ‘assessment date’ with only very limited scope for reassessment or revision of the tax should there subsequently be a dramatic fall in value.

- There would be the option to pay the tax over five years, with further deferral possible in defined circumstances of illiquidity. Payment of tax in respect of pension fund wealth would automatically be deferred until retirement.

- There should be little or no advance warning of the implementation of the tax, so as to minimise the effect of ‘forestalling’ or advance planning.

- The tax should, broadly, be levied on people who are tax-resident in the UK on the ‘assessment date’ and by references to assets whether in the UK or overseas. But special rules would apply to both recent arrivals in the UK and to people who had left the UK shortly before the ‘assessment date’.

- Non-residents would be liable only in respect of UK real property.

- Trust assets would be included if the settlor or a beneficiary was UK-resident at the ‘assessment date’.

- The assets of minor children would be aggregated with those of parents. Spouses and civil partners could elect to be taxed as a unit.

- At thresholds of £500,000, £1m and £2m per person, a wealth tax would respectively cover 17%, 6%, and 1% of the adult population. An illustrative rate of 1% at a threshold of £1 million per household (assuming two individuals with £500,000 each) would raise £260 billion over five years after administrative costs.

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Letter of Confirmation of Residence

It can be daunting going to work in a foreign country, or coming to work in the UK. Understanding how tax and social security are affected by making such a move can add to the list of complexities you have to deal with.

CONFIRMING UK TAX RESIDENCE

As a new UK resident, foreign tax authorities are often forthcoming with their requests for proof of UK tax residence. The tax authority in Greece for example may require a former resident of Greece to prove that he or she is now regarded by HMRC as a resident of the UK. Customers may also want HMRC to confirm that they are regarded as UK resident so that they can claim relief from foreign taxes which they might be entitled to under the domestic law of the foreign state rather than under the terms of the UK’s DTA with that other state.

Our personal tax desk at Mouktaris & Co is thoroughly versed in the process of obtaining proof of UK tax residence. As a first step, it’s important to distinguish what exactly is required.

LETTER OF CONFIRMATION OF RESIDENCE VS CERTIFICATE OF RESIDENCE (COR)

A Letter of Confirmation of Residence is confirmation that the taxpayer is regarded by HMRC as a resident of the UK for purposes other than claiming relief from foreign taxes under the terms of a Double Taxation Agreement (DTA).

The worked required to obtain a Certificate of Residence (CoR) on the other hand is more involved and will require the taxpayer to outline the following:

- why a CoR is needed

- the double taxation agreement under which a claim is sought

- the type of income under which a claim is sought and the relevant income article

- the period for which the CoR is needed

TAX RESIDENCE WHEN COMING TO THE UK, OR LEAVING THE UK

Having moved to the UK, an overseas assignment may turn out to be a permanent move; similarly a stint abroad may be intended for a finite length of time. In any case the length and timing of one’s time spent outside the UK, any return visits made to the UK and what personal ties are maintained with the UK are important. These factors will determine tax residence when coming to the UK in the year of arrival, or leaving the UK in the year of departure. The taxation of residents and non-residents is very different.

- The starting point is the Statutory Residence Test (SRT), in which you are either UK resident or non-resident for the whole tax year. Provided that you continue to meet the Statutory Residence Test conditions in any given tax year (6 April – 5 April), you are considered UK or non-UK resident.

- If however during a tax year you start to live or work abroad, or come to the UK, then ‘split year treatment’ may apply. There are 8 cases where the criteria for ‘split year treatment’ can be met:

- Starting full time work overseas

- The partner of someone starting full time work overseas. Under UK law, spouses and civil partners are generally treated entirely separately for tax purposes. This means that the tax residence position of your spouse or civil partner needs to be considered based on his or her own facts and circumstances. However, in some cases it can be influenced by your own tax residence position.

- Ceasing to have a home in the UK

- Starting to have a home in the UK only

- Starting full time work in the UK

- Ceasing full time work overseas

- The partner of someone ceasing full time work overseas

- Starting to have a home in the UK

- Where the conditions are met this splits the tax year into 2 parts:

- A UK part for which you are UK resident, in which you are charged to tax as a UK resident

- An overseas part for which you are non-resident, in which, for most purposes, you are charged to tax as a non-UK resident. ‘Split year treatment’ however does not affect whether you are regarded as UK resident for the purposes of a double taxation agreement.

ADVISING ON TAX RESIDENCE IN THE YEAR OF ARRIVAL OR LEAVING

Based on the above and in order to advise properly, it’s important to:

- understand one’s motivations for leaving or coming to the UK, under one of the 8 cases above;

- clarify one’s intended leaving or arrival date and the conditions and constraints for spending time in and out of the UK during the tax year;

- appreciate and quantify the repercussions of not achieving ‘split year treatment’ in a particular tax year both in terms of UK and non-UK taxation, and subsequently identify what would be required to achieve non-UK-residence status in the subsequent tax year

Whether you’re an existing client or don’t yet use our services, we would be pleased to help you. Contact Mouktaris & Co Chartered Accountants for expert advice or click here to subscribe to our Newsletter.

Coronavirus: Help for the Self-employed

Expanding the UK Government’s measures to protect people and businesses from the economic impact of coronavirus, the Chancellor now focused on self-employed individuals (including members of partnerships) whose incomes have suffered.

The Self-employment Income Support Scheme, announced on 26 March 2020, will come as a welcome relief to those in self-employment, who comprise 15.3% of the UK’s workforce. The new scheme will cover 95% of those who are self-employed.

Under the scheme, a grant will be provided to self-employed individuals or partnerships, worth 80% of their profits up to a cap of £2,500 per month. This brings parity with the Coronavirus Job Retention Scheme, announced by the Chancellor last week, where the Government committed to pay up to £2,500 each month in wages of employed workers who are furloughed during the outbreak.

Second lump sum for self-employed [29/05/2020 UPDATE]

The Chancellor has announced a second and final grant to the self-employed who are eligible for the Self-employment Income Support Scheme (SEISS), based on 70% of earnings and capped at £6,570.

HMRC has confirmed the same eligibility criteria will be used to establish self-employed individuals’ entitlement to a further SEISS grant; the grant will be 70% rather than 80% of average earnings for three months and the maximum amount will be capped at £6,570, down from the £7,500 for the first grant. Applications will open in August and HMRC expects to publish further guidance on 12 June. As with the first claim, the second claim has to made by the taxpayer and cannot be made by agents.

QUALIFYING FOR THE SCHEME

- Self-employed or a member of a partnership

- Lost trading or partnership trading profits due to coronavirus (Covid-19)

- Filed a Tax Return for 2018-2019 as self-employed or a member of a trading partnership

- Eligible individuals who have not yet submitted 2018-2019 Tax Returns will have another four weeks to file in order to become eligible for this scheme (at time of writing a deadline of 23 April 2020).

- Not applicable to anyone who started trading in 2019-2020.

- Traded in 2019-2020 and were trading up until the point of application (or would be except for coronavirus)

- Intend to continue to trade in the tax year 2020-2021

- Trading profits of £50,000 or less and more than half of your total income come from self-employment. This can be with reference to at least one of the following conditions:

- Trading profits and total income in 2018-2019

- Average trading profits and total income across up to the three years between 2016-2017, 2017-2018 and 2018-2019.

We are doing everything we can to help our business community. If you would like to discuss how the changes or the coronavirus pandemic may affect you or your business, please do not hesitate to contact us on 020 8952 7717 or use our online enquiry form.

Negotiating time to pay with HMRC

HMRC has published details of the specific helpline to contact, but it’s not known whether HMRC will change its usual approach to time to pay, for taxpayers who are having difficulty paying.

The following usually needs to be considered when negotiating time to pay with HMRC.

WHEN TO MAKE CONTACT – In general it is advisable to contact HMRC as soon as difficulty making payment is expected. However, HMRC’s systems do not easily facilitate setting up a payment arrangement too far in advance, so the best time to phone HMRC is usually one to two weeks in advance of the due date for payment.

MAKE SURE RETURNS ARE UP TO DATE – HMRC is more amenable to agreeing time to pay if returns are up to date and the correct liability has been established.

CASH FLOW FORECASTS AND BUDGETS – Before phoning HMRC it is advisable to have financial forecasts and a statement of assets and liabilities available. HMRC will expect the taxpayer to make the best offer they can and will not usually make suggestions about the amount it will accept as a regular payment.

HMRC STAFF AUTHORITY TO AGREE TIME TO PAY – HMRC will usually expect to set up a regular monthly payment plan with collection by direct debit. Most HMRC debt management contact centre staff have authority to agree time to pay over a period of up to 12 months. Longer periods can be arranged but usually need to be escalated to more senior HMRC staff.

EXPECT ROBUST QUESTIONING – We don’t know to what extent HMRC staff will be more sympathetic to requests for time to pay in the current environment but in normal circumstances negotiating time to pay can involve what feels like personal and intrusive questioning. It is important to make HMRC aware of all information which might be relevant to the payment difficulties, as calmly and professionally as is possible in what may well be extremely difficult circumstances.

NO AGREEMENT MAY BE BETTER THAN AN UNAFFORDABLE AGREEMENT – It is often better to conclude a phone call to HMRC having failed to reach an agreement than to agree to an arrangement which the business can’t afford. If a time to pay agreement is not kept to it is difficult to get HMRC to reestablish it and HMRC will be more reluctant to make agreements in the future. If circumstances change it is advisable to contact HMRC, before missing any payments, to renegotiate the arrangement. If a formal time to pay arrangement cannot be reached it is usually advisable for the taxpayer to pay what they can when they can as this shows willingness to pay and may delay further enforcement action by HMRC (this approach may not be appropriate if insolvency is likely and further advice should be sought in this situation).

FUTURE TAX LIABILITIES – A standard term of HMRC time to pay agreements is that future tax liabilities are paid in full as they fall due. Where this is not possible it is necessary to contact HMRC again to renegotiate the arrangement to include the new debt. HMRC is often reluctant to agreed repeated requests for time to pay but may be more amenable in the current situation.

WHICH DEBTS TO PRIORITISE – HMRC is usually more willing to consider agreeing time to pay for profits based taxes such as income tax and corporation tax than for taxes such as VAT and employees’ PAYE and national insurance contributions, which businesses are effectively collecting on behalf of the exchequer. The usual advice is to prioritise paying VAT and employer liabilities as HMRC pursues these more actively. We don’t yet know whether this will change in the current situation; there has been some speculation that the Government may be minded to focus assistance on VAT and employer liabilities but no announcement has been made.

LATE PAYMENT PENALTIES – An advantage of a formal time to pay arrangement is that late payment penalties will not be charged if the arrangement is in place at the trigger date for the penalties. We don’t yet know whether HMRC will be more willing to waive late payment penalties in the current situation but the helpline page suggests that the cancellation of penalties will at least be explored.

INTEREST – In normal circumstances HMRC does not waive interest unless the delay in making payment is somehow directly attributable to HMRC. We don’t yet know whether HMRC will be more willing to waive interest in the current situation but the helpline page suggests that the cancelling of interest will at least be explored.

ALTERNATIVE WAYS TO CONTACT HMRC – As well as the COVID-19 helpline HMRC has regular payment helplines. Large businesses with a customer compliance manager should contact that individual. If the debt is a result of a compliance check any anticipated difficulty with making payment should be discussed with the compliance officer, ideally before reaching final settlement.

We are doing everything we can to help our business community. If you would like to discuss how the changes or the coronavirus pandemic may affect you or your business, please do not hesitate to contact us on 020 8952 7717 or use our online enquiry form.

How to Invest Business Profits

With many entrepreneurs accumulating cash in business accounts, the question of “how to invest business profits?” is a favored topic when planning.

Entrepreneurs work hard for their businesses and this short article explores how business funds can work hard- or most effectively, for entrepreneurs.

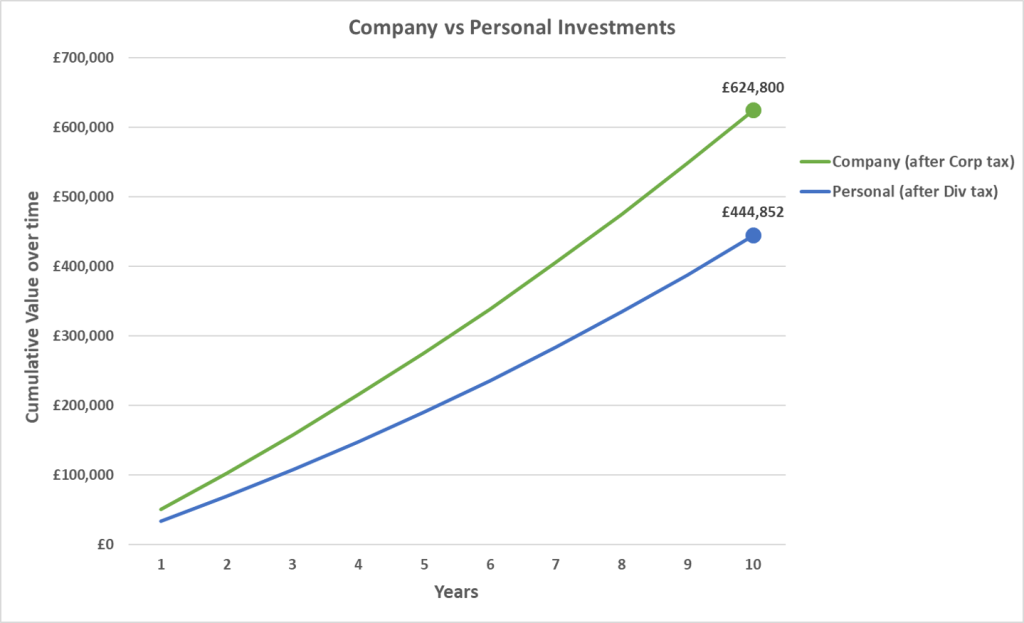

Let’s take the following scenario: your business is profitable and has accumulated cash. During the years of trading, you have typically drawn an annual salary and dividends of £45,000, a point at which you are paying the basic rates of tax. Now with a stockpile of cash in the business, there are two options through which to invest. Should you personally draw additional funds from the company to invest, or alternatively should you invest from within the corporate structure?

Assume in both cases there is a £50,000 cash surplus in the company. Assume also that this happens every year for the next 10 years.

Personal investment through your ISA

To take the money out of the company, you would pay dividend tax of 32.5% upfront. You (and perhaps your partner) could then invest your money tax-free, say in an ISA wrapper, in which your combined ISA allowances are currently £40,000.

Investment through your Company

Investing the money within the company would mean no upfront dividend tax of 32.5%. You would instead pay corporation tax on the investment income and gains annually, with the caveat that dividends received from stocks and shares are mostly exempt from corporation tax. This is a considerable advantage.

Let’s see how the two strategies fare:

As you can see, investing the money in a limited company yields approximately £180,000 more over a ten-year time horizon. The cost of paying the dividend tax upfront outweighs the benefit of tax-free personal investments. Why should you lose out?

Compounding evidence

You will notice immediately from the graph above that investing your company’s profits in the corporate vehicle, without paying dividend tax, allows the investment to accumulate, or compound, at a faster rate, even after paying corporation tax on investment income and gains.

Sure, if you do not draw the surplus funds from your company you may need to take a 32.5% dividend tax rate hit at a later date, but in the interim you will have generated greater income through compounding.

Caveats

Here we assume constant tax rates at the points of execution, income and realisation. It would be unwise to speculate on domestic policy, but current political trends and economic philosophy may see a conservative government try to enforce its stronghold on previously labour heartlands. Corporation and dividend tax rates could well rise before they fall.

You may find that transaction costs are slightly higher for corporate accounts, chipping away at annual returns. You will need to shop around harder for a broker. Equally personal brokerage accounts tend to be more insurable than corporate accounts.

Investing through a Limited Company

If the preference for investing through a Limited Company has been established, so should the mechanism through which to do so. Yes, you could simply open an investment account for the existing trading company, however there are several reasons why a designated investment company is superior:

- If the trading company runs into legal issues, the investment company will be protected.

- The trading company can be sold off as a standalone vehicle without the need for complex restructuring.

- An investment company will have minimal expenses and overheads, meaning it will be easier to administer for tax purposes (no VAT or payroll requirements).

- A trading company shouldn’t start investing in activities outside its core functions as it could end up becoming reclassified. This may carry tax implications, especially if Entrepreneurs’ Relief is sought.

Whilst the trading company is often the vehicle in which profits have been generated and accumulated, there are tax neutral ways of shifting funds to an investment company, such as lending the cash surplus. There is no obligation to pay back the loan and one can be the sole director of both companies.

A Holding Company

A holding company structure that owns operating companies and receives dividends is favourable. The holding company can own shares in the subsidiary trading companies and can provide centralised corporate control. Additionally, no taxes would be incurred when the trading company is sold.

Special Purpose Vehicle (SPV) for Property

If you want to invest in property it may be a better idea to set up an SPV. This is often a requirement from buy-to-let lenders. If you are looking to acquire a primary residential residence however, personal ownership is often the best way to go.

Don’t let the tax tail wag the investment dog

Your investment goals will seek a level of risk and return that you are comfortable with, regardless of the structure through which you pursue them. The tax wrapper is the “cherry on the top”, though worth a certain percentage of your annual returns. Contact Mouktaris & Co Chartered Accountants for an accountant who understands your investment strategy and can help you plan accordingly.

Non-resident Taxation of Income from UK Property

Finance Act 2019 has introduced two changes to the taxation of non-resident income from UK property:

- From 6 April 2019, disposals of direct or indirect interests in UK land are brought into the Territorial scope of charge; and

- From 6 April 2020, income from a UK property business is moved out of the charge to income tax and brought into the charge to corporation tax.

Background: the position until 5 April 2020

Non-UK resident companies have been subject to income tax in respect of property income arising in the UK. Tax has been chargeable at the basic rate of 20%. These companies are required to complete a Non-resident Company Income Tax Return (SA700).

Finance Act 2019

Coming into effect from 6 April 2020, income from a non-resident UK property business will now be subject to corporation tax rather than income tax. The corporation tax rate is currently charged at 19%: 1% point lower than the equivalent income tax rate. The details of profits to be charged with corporation tax will be included on a company tax return form CT600, as opposed to the SA700.

From an administrative point of view, the annual company tax return will include details of both UK property business income and any property disposals for the accounting period as a whole, on which corporation tax will be due. The filing deadline is 12 months after the end of the accounting period, though in practice, this will be filed 9 months after the end of the accounting period: the point at which any corporation tax is due.

Property losses and allowable deductions

Profits and losses will accordingly be drawn up under corporation tax principles according to the rules of CTA 2009 Part 4.

Loan relationships or derivative contracts that the non-resident company is party to for the purposes of its UK property business are also brought into the charge to corporation tax.

For companies that have net deductible interest and financing costs of over £2 million per annum, there will be a limit to the amount that the company can deduct: the Corporate Interest Restriction.

Transitional rules

UK property business income tax losses carried forward at the point of transition, 6 April 2020, will be grandfathered and therefore deductible under corporation tax rules against future income of the property business.

Capital allowance balances will transfer between the two regimes in such a way as to produce no balancing allowances or charges.

Notably, if a company’s only source of UK income after 6 April 2020 is expected to be income from the UK property business, no Income Tax payments on account for 2020/2021 and future tax years will be required. Similarly, if a credit balance remains in the company’s Income Tax account after all Income Tax liabilities for 2019/2020 and earlier years have been settled, the credit balance will be repaid to the company.

Annual Tax on Enveloped Dwellings (ATED)

ATED on residential properties owned through a corporate structure with a value of more than £500,000 continues to be unchanged following the Finance Act 2019. As ever, ATED can be relieved in full for residential property that is let to a third party on a commercial basis and isn’t, at any time, occupied (or available for occupation) by anyone connected with the owner. Other reliefs can be claimed as per sections 30 to 41 of the ATED technical guidance.

Capital Gains Tax (CGT) on UK property

Non-residents, both individuals and companies, are taxed on almost all gains made on disposals of UK residential properties. Since 6 April 2019, non-UK residents who make an indirect disposal of an interest in UK land will also be brought into the Territorial scope of charge, with the new s1A of TCGA 1992 Part 1. Indirect disposals can for example be disposals of shares in a non-UK entity that derives at least 75% of its value from UK land, provided that the person making the disposal has an investment of at least 25% in that company. The scope of taxation for non-residents has been extended from targeting UK residential property specifically, to now including commercial property and disposals of shares in so-called ‘property rich’ entities. Disposals will be reported in the annual company tax return.

Mouktaris & Co have experience in helping clients navigate the regulatory, accounting and tax matters of property businesses. Our team can review your corporate structure and advise on whether it may be beneficial to de-envelope or restructure in other ways, to take heed of an almost even UK vs non-UK playing field. This will include reviewing potential capital gains tax, stamp duty and inheritance tax liabilities as well as commercial considerations of raising finance and banking relationships in the UK and offshore.

Contact Mouktaris & Co Chartered Accountants to find out how we can help your property rental business.

Offshore Income: in the Firing Line of the Worldwide Disclosure Facility

As predicted, HM Revenue & Customs (HMRC) has started firing, quite unpredictably, Certificates of tax position concerning offshore income or gains. In the firing line are taxpayers who the revenue believes have not correctly disclosed their worldwide income to HMRC. The requirement for a UK resident to disclose and pay tax on all overseas income and gains is age-old, but was often overlooked: clouded by the murky waters that separated national tax positions. Now the gunpowder, or information source, are the Common Reporting Standards (CRS), a commitment by over 100 countries to exchange taxpayer information on a multilateral basis and increase international tax transparency.

Past, Present or Future?

Taxpayers are being encouraged to use HMRC’s Worldwide Disclosure Facility (WDF) to come clean and disclose their non-UK income and assets, including additional tax liabilities together with penalties and interest. This could include income arising from a source outside the UK, assets situated or held outside the UK or activities carried on wholly or mainly outside the UK. The challenge can surmount to a daunting prospect for wealthy individuals with global, inter-connected and complex tax affairs. The declaration will affect not only past, but also future tax liabilities.

As part of the disclosure, made via the online Digital Disclosure Service, the taxpayer also needs to self-assess his or her behaviour, ranging from “careless” to “deliberate and concealed”. This self-assessment is an integral part of disclosure that determines the penalties applied and whether further action is warranted. Understanding the spirit of the Requirement to Correct (RTC) legislation is therefore crucial, for mis-reporting could compound the already very penile penalty rate, equivalent to 200% of the tax liability which should have been disclosed to HMRC under the RTC but was not. Rather frightfully, HMRC reserves complete discretion to conduct a criminal investigation in relation to the disclosure, whether it appears to be complete or incomplete.

The inevitable question arises: how much does HMRC now know, or rather, not know.

Tax investigations can be stressful if you are going it alone and most often merit professional advice. Our team of advisors in North West London is here to help.

Contact Mouktaris & Co Chartered Accountants to ensure that you report correctly and avoid the potential repercussions, of getting it wrong.

The taxation of Cryptocurrency profits is not so virtual

Cryptocurrency investors navigating 100% price swings and exchanges with generous down-time have, this tax season, encountered another hurdle: the tax authorities. Whilst the question “should I report my bitcoin profits?” was clarified by the Inland Revenue some four years ago, the more sobering questions of “how to report bitcoin profits?” and “how much will I be taxed?” have made it to the front of the line.

Whilst bitcoin continues to stir controversy for its inherent value, how bitcoin is accounted for is a far less epistemological thought- rooted in the International Financial Reporting Standards which, unsurprisingly, have not budged.

Currency (why don’t you come on over)

Cryptocurrency is not issued or backed by any government (at least for now), and so cannot be classified as “cash”. Nor does cryptocurrency confer to the holder a contractual right to receive cash or another financial asset (excuse the formulaic definition of “financial instrument”). Of course bitcoin has no physical form, so it cannot be accounted for as “property, plant and equipment”. This narrows down its classification to either of two forms, depending on the circumstances of the investor.

Inventory

Inventories are held for sale in the ordinary course of business. If you are a private investor who actively trades in bitcoin, for example, but not restricted to, “mining” coins, HMRC will view your ownership of bitcoin to be “for sale in the ordinary course of your business”. Consequently your profits will be deemed to be “income” which, as you know, is taxed at 20%, 40% and 45% instead of 10% or 20% as with Capital Gains Tax (CGT). HMRC and the courts will apply any of nine “badges” in deciding whether an activity constitutes a trade so professional advice should be sought on the optimal setup for a trader, as well as the tax and reporting implications.

Intangible assets (IAS 38)

Cryptocurrencies also meet the definition of an intangible asset: one which can be sold, exchanged or transferred individually and which has no physical form. This treatment of bitcoin as an intangible is pioneering for three reasons:

- This intangible asset is traded with a profit motive. Remember, intangible assets, say patents or brand names, have traditionally been assets held for use in the production process.

- Because of its essence in having no physical form, bitcoin carries low detection risk, compounding the profit motive above.

- Scale, and the sheer volume of investors who have crowded into this trade, compounding one and two above.

Taxation of bitcoin as an intangible attracts CGT at the less penile rates of 10% and 20%, depending on your tax bracket. In this case, investors would do well to seek professional advice on the correct measurement basis of gains and, for example, working out the tax when you have held different parts of your bitcoin portfolio for different periods of time.

How will they know (if I really own it)?

One theme from this tax season has been the reportability of cryptocurrency-related profits (though surprisingly, not so much losses!?). Note the following: UK-based trading platforms must provide data to HMRC on their customers. This may seem a moot point for now because the vast majority of cryptocurrency trading in the UK takes place on overseas exchanges, which may explain the low incidence of tax investigations. In this era of cross-border information sharing however, cross-border information sharing of cryptocurrency activity, and traders, may not be far away. In the US, Coinbase, the country’s most popular exchange, has already handed over identity information of 14,000 of its most frequent traders to the Inland Revenue Service. It would be fair to assume that HMRC too will tackle this traceability issue heads-on: tax payers who do not properly report their gains of virtual currency transactions may find themselves with penalties and interest.

Investment in cryptocurrencies merits investment in professional advice, whether you have made profits, or losses.

Contact Mouktaris & Co to ensure that you report correctly, structure optimally and avoid the pitfalls, and potential repercussions, of getting it wrong.

Stay compliant, and keep hydrated.

Autumn Budget 2017

Chancellor Philip Hammond presented the 2017 Autumn Budget against a backdrop of ongoing economic uncertainty. In no uncertain terms, this was a glum budget. The Office for Budget Responsibility revised down its outlook for productivity growth, business investment and GDP growth across the forecast period, though the chancellor challenged the nation to “prove them wrong”.

Off we go.

The Chancellor announced the immediate abolition of stamp duty land tax for first-time buyers on homes worth under £300,000, and a rise in the tax-free Personal Allowance to £11,850 from April 2018.

Also unveiled in the Autumn Budget was a change to business rates revaluations: these will now take place every three years, as opposed to every five years, beginning after the next revaluation, currently due in 2022. The Chancellor also addressed the issue of the so-called ‘staircase tax’.

Our Budget Report summarises the key announcements arising from the Chancellor’s speech. Additionally, throughout the Report you will find useful tips and ideas for tax and financial planning, as well as an informative 2018/19 Tax Calendar.

Don’t forget, we can help to ensure that your accounts are accurate and fully compliant, as well as suggest strategies to minimise your tax liability and maximise your profitability.

If you would like more detailed, one-to-one advice on any of the issues raised in the Chancellor’s Budget speech, including on the ensuing tax implications, please feel free to call on 020 8952 7717 to see how we can help.

- ‹ Previous

- 1

- 2

- 3

- Next ›